While Taiwan’s TaiSPO International Sporting Goods Show was once the go-to show for sports equipment buyers from across the globe, a repositioning is needed to deliver a new generation of meaningful growth for the industry.

This time three years ago I visited Taiwan’s International Sporting Goods Show (TaiSPO) for what was the first time in more than a decade. The experience motivated me to write an opinion-piece. In the piece, I raised the viewpoint that it was time for a rethink of the TaiSPO event; to move away from the show’s long-held sourcing orientation to that of a more market-oriented show. The thought was a simple one: Taiwan’s position as contract-manufacturer to global brands has largely passed, and, along with it, any significant growth opportunity for businesses and for wages. At the same time, the market for sports in Asia is expanding at an exponential rate, bringing with it a new generation of business opportunities. If TaiSPO could successfully reposition itself as Asia’s major sports industry show, Taiwan just might find itself at the center of Asia’s coming trillion dollar sports market.

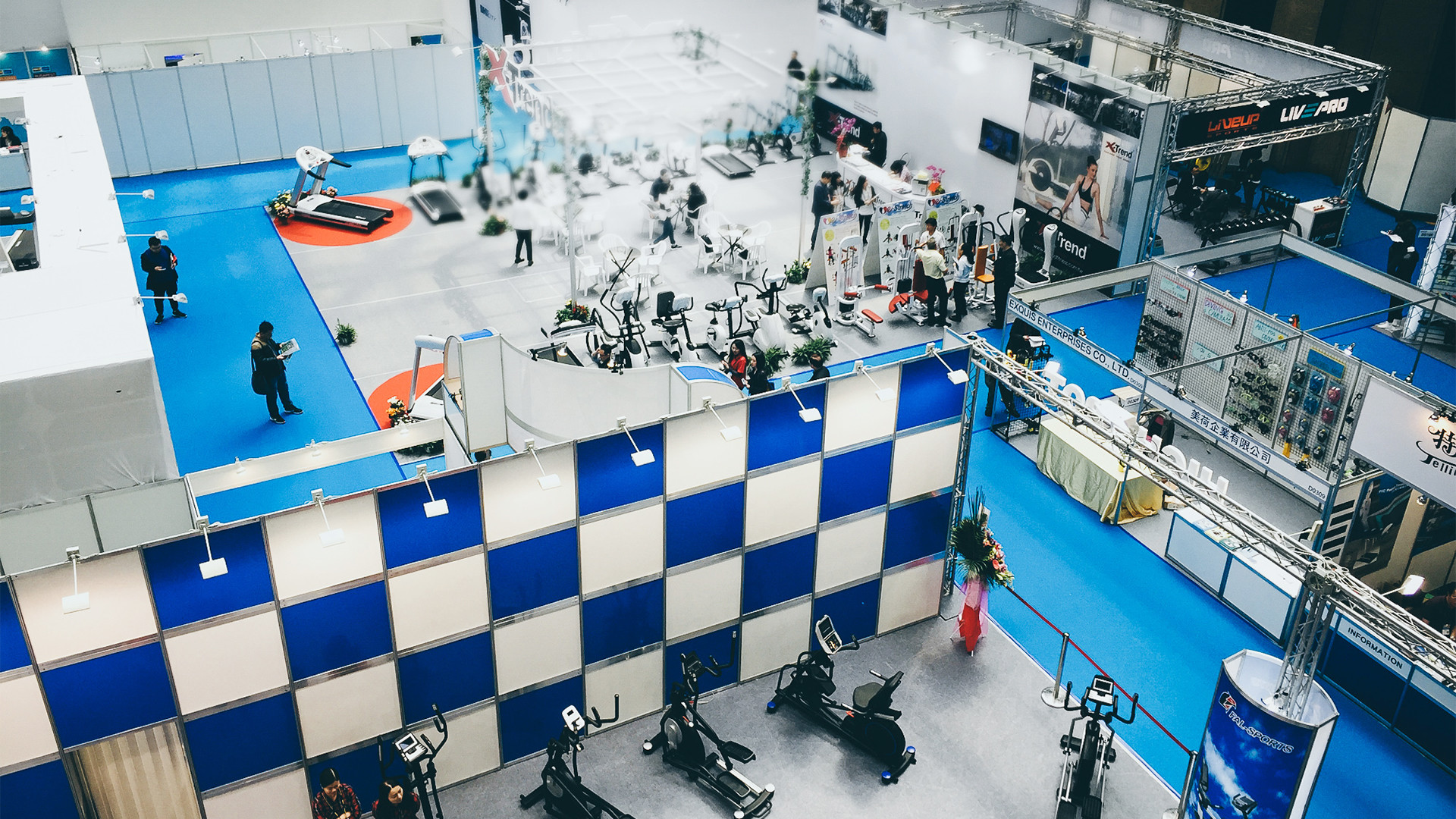

Yesterday, three years since I wrote the article, I visited TaiSPO once again. It was my hope to see a show that championed more than just OEM products. I hoped for a show that also celebrated the culture that surrounds those products: the brands, the trends, the communities, and the personalities. The broader positioning of such a market-focused would have the potential to attract influential market players—retailers, service providers (gyms, trainers), event organizers, and media—from Japan, Korea, China, and Southeast Asia. Rather than coming at a cost to Taiwan’s OEM equipment makers, the chance to be closer to the market would bring new business opportunities and boost own-brand initiatives.

My visit yesterday was encouraging on some levels. Johnson and Intenza Fitness, two leading fitness equipment makers, are showing the way forward with showrooms that look more like working gyms than a trade show booth. In place of showgirls, professional trainers introduce compelling, market-ready fitness programs that work in tandem with each company’s latest product offerings. The show’s organizers also deserve credit for what appears to be a move closer to the market. Of particular note are the forums happening off the show floor. This year’s show features keynote speakers expounding on a range of topics relevant to today’s sports market, such as ‘fitness club management’ and ‘how to organize a marathon’.

A majority of the show floor, however, stands in stark contrast. Booths are largely empty and there is little of the buzz and excitement that one experiences when attending sports trade shows in Europe and North America. While changes are afoot, there is still a significant gap between today’s TaiSPO and what is Taiwan’s grand opportunity to establish itself as the torch-bearer for Asia’s burgeoning sports market.

A visitor to this year’s show might ask if TaiSPO can justify its claim as an international sporting goods event. The show has become more or less a reflection of those segments in which Taiwan remains competitive—in today’s case, indoor fitness equipment. To be sure, Taiwan’s indoor fitness equipment industry segment is a success story to be celebrated. Exports of fitness equipment represent more than 40% of Taiwan’s total sports industry exports (excluding bicycles and footwear) and revenues reached a total of NTD20 billion (USD660 million) in 2016. However, strong growth in recent years, driven largely by a global expansion of fitness clubs and hotels, is likely to soften in coming years, leaving Taiwan’s total sports industry with limited room for growth.

While there are solid revenues to be made from the manufacturing and export of sporting goods, Taiwan is missing out on the real growth opportunity in sports. The true potential for sports is in the market, which reaches beyond equipment into services (e.g. fitness clubs, sports venues, coaching), activities (e.g. running races, sports leagues), the channel (e.g. online/offline retail) and marketing (e.g. sports sponsorship). One can be sure that without a viable sports market—its activities, events, media and culture—there is a limit to how much product can be sold.

In developed countries, the sports market (of which sporting goods equipment is a subset) contributes anywhere from 1% to 3% of a nation’s Gross Domestic Product (GDP). In the case of the United States, sports represent 2.69% of the nation’s yearly GDP. In developing nations, quite naturally, the percentages are lower. However, these numbers do rise as economies develop, as is the case today for not only Taiwan, but also China, Korea and, increasingly, the nations of Southeast Asia. Widespread popularity of running and the explosive growth of boutique gyms, to name just two recent trends, play witness to Taiwan’s growing appetite for sports and those of other major cities across Asia.

Wang Jianlin, chairman of Wanda Group, was recently quoted as saying "The scale of China's sports industry and relevant industries, including sportswear manufacture, amounted to just USD50 billion (NTD1.5 trillion) dollars in 2014. America's sports industry turned out USD500 billion (NTD15 trillion) dollars that year and has been growing, even with only sports games and sports activities being counted.” He estimates that China’s sports industry will reach 1% of GDP by 2020, representing a three trillion yuan (USD463.7 billion) opportunity in China alone.

While the China market might not be the primary target for Taiwan as a result of recent political winds, Taiwan can be looking to the rest of Asia for opportunities. Given the island’s location, and the fact that Taiwan’s sports market and industry is well ahead of those of developing markets such as Thailand, Malaysia, the Philippines and India, there is no reason why Taiwan couldn’t reasonably play host to Asia’s biggest sports industry trade show.

TaiSPO can be commended for its recent moves to integrate more market-oriented forum topics at this year’s event. It’s now necessary to go one step further; to bring more of the market and the culture of sport to the show floor. The show’s organizers could do well to learn from other market-oriented sport industry shows such as ISPO and EuroBike. Understanding the strategies and operations of these shows or bringing on a consultant or two with experience in organizing such events could embolden the effort.

An event like TaiSPO has the potential to put Taiwan at the center of Asia’s growing sports industry, to open doors to new opportunities in the market, and to help Taiwan expand beyond its heavy dependence on manufacturing products. If TaiSPO successfully transitions from a pure sourcing show to a market-driven show, Taiwan just might find itself at the center of Asia’s coming trillion dollar sports market.